Multimedia content

- Images (1)

- Gabon Seeks Fresh Investment to Unlock Untapped Oil & Gas Potential

- All (1)

Gabon Seeks Fresh Investment to Unlock Untapped Oil & Gas Potential

A key emphasis by Gabonese officials was placed on the marginal oil fields in the country to counter oil production decline linked to the natural lifecycle of its fields

Through our technical workshops and yearly statutory meetings, we will continue to monitor the overall performance of these assets, including safety, production, people and budget

Gabon is calling for renewed international investment in its oil and gas sector, focusing on marginal oil fields to counteract declines from aging reservoirs.

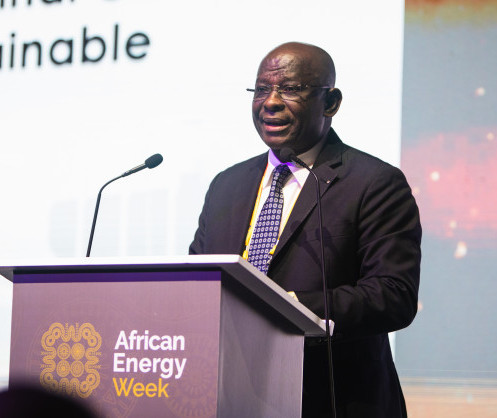

Speaking at a session titled ‘Unlocking Investment Opportunities in Gabon’s Oil & Gas Sector’ at Africa Energy Week: Invest in African Energies, Aristide P. Nyamat Bantsiva, General Director of Upstream Oil and Gas, highlighted the government’s push to revitalize production from mature fields and capitalize on untapped resources.

Gabon’s 2019 Hydrocarbon Code reforms, which include flexible production sharing contracts and tax incentives, aim to stimulate exploration. The country has more than 30 marginal discoveries across onshore and offshore blocks, which officials hope will drive sustainable production growth and economic revitalization.

“The advancement of technology has allowed us to review and discover new blocks that were previously thought inaccessible. Through our technical workshops and yearly statutory meetings, we will continue to monitor the overall performance of these assets, including safety, production, people and budget,” Bantsiva said.

Bantsiva noted that Gabon has over two billion barrels of proven oil reserves and substantial gas potential. Yet only 27.5% of its 255,104 km² total acreage is currently licensed, leaving nearly 185,000 km² open for investment.

“The government, through partnerships with operators such as Perenco, BW Energy and state-owned Gabon Oil Company, is leveraging these enhanced oil recovery technologies and redeveloping underutilized assets to maximize output from mature fields,” he added, emphasizing that tapping deepwater basins will require additional investment and technical expertise.

Meanwhile, independent energy company Perenco is investing $2 billion into the Cap Lopez LNG terminal, deploying a floating LNG vessel capable of producing 700,000 tons of LNG and 25,000 tons of LPG, with 137,000 cubic meters of storage. BW Energy also signed production sharing contracts for the Niosi Marin and Guduma Marin blocks in 2024, covering an eight-year exploration period with a two-year extension option.

“With established infrastructure, including over 225 km of gas pipelines, 7 million barrels of storage capacity, and a functioning refinery system, as well as continued commitment from government, Gabon offers a compelling opportunity for investors to be part of the next chapter in Africa’s energy story. Our oil basin is rich in history and ripe for innovation,” Bantsiva concluded.

Distributed by APO Group on behalf of African Energy Chamber.